Jipay has partnered with Etica the fastest growing Unit Trust Fund Manager in Kenya. Etica is licensed by the Capital Markets Authority in Kenya. Jipay has access to Etica’s 100,000 customers. Jipay is planning a pan-African roll out beginning in Kenya. Kenya’s gross saving rate was at 12.1% of GDP in 2022. This a poor comparison to a country like India which was at 30.2% in 2023. We have a long way to local capital sufficiency. Meaning we have to engage high cost debt for projects in the country. 83% of the workforce in Kenya is on contract or self-employment. This makes it difficult for them to set up standing orders to save because of the variable nature of their income. The go to option for the 15.9 informal workers has been the mobile loan apps which charge interest’s north of 180% per annum. This has led to poor credit rating for many borrowers on account of defaults. We have about 14 million negative listings at the local credit reference bureaus. The impact is stiflied capital access for the bulk of the population.

About JiPay

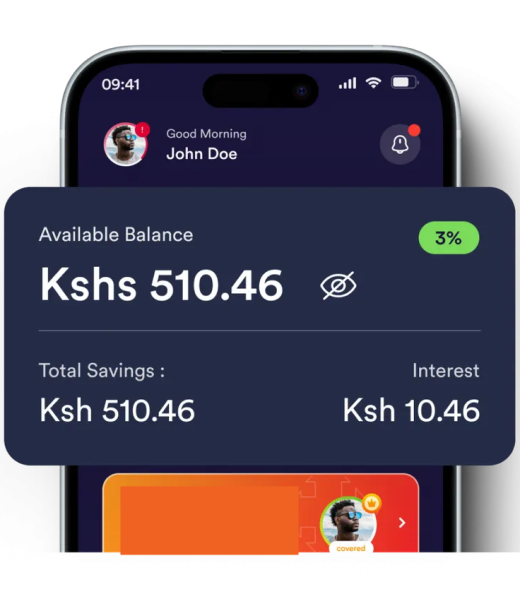

JiPay is a micro-savings wallet built for informal workers in Africa, by Africans. We are using our novel Save As You Spend solution to capture micro-savings at the point of spending by integrating with Mpesa. Our app, Jipay is available on Android phones. Our mission is to enable Universal Health Coverage (UHC) by way of Jipay Afya a primary healthcare micro-insurance. This micro-insurance cover offers In and Out patient cover for a family of five. We are also enabling financial inclusion through Jipay Later, A micro-savings solution that mobilizes savings for education, business capital and holidays. This is made possible by savings by automatically saving 10% of all you spend as a subscriber

We appreciate the feedback from our clients

I thank the Lord for connecting me with you. I would have never known anything called money market funds. I will have to use the savings there. Imagine if I didn’t have this! I would be going for Sacco loan or Harrambee. Thank you.

Chepkirui Bor

Our History & Motivation

In April of 2019 my brother Charles and I were seated at Flava and Spyce waiting for our soul food order prepared by Chef Maina. We had agreed to meet for lunch and discuss financial planning. Charles had a good job and was making a tidy sum of money. After I laid out a financial plan for him to consider, he looked me in the eye and said to me “you know betting is a form of investment”. I was dumbfounded for a minute as I struggled to put together a response that was not condescending. As the first born I had come to learn to be gracious with my siblings who are way bigger than me in frame. He went on to get a few wins and lost a lot of money that he never spoke about. Needless to say that he never invested in the financial assets that I had proposed. His view of betting broke my heart when I realized that millions of young and old people were losing money in the same way, especially in vernacular radio stations in Kenya. I cried out to God to show me how I could turn the punters into savers by engaging them in the same ecosystem, Mpesa. Four months later God answered my cry with the novel idea of catching savings at the point of spending. Save As You Spend. Each and every time a wager of 500/= is placed 10% of that or 50/= would go into an interest earning account. Punters know what is a sure bet and in the fullness of time they would be weaned out for the vice through Jipay Now I went ahead to form Jipay Payment Solutions together with like-minded partners and the journey to evangelize the punters began with earnest. Since then we have encountered other problems that have become services such as Jipay Afya,Jipay Later and the list will keep growing.